Financial inclusion is an essential and highly discussed topic not only in South Africa but globally. Increasing people’s access to financial services is often recognised as an effective measure to reduce poverty and income inequality.

The informal sector will continue to contribute massively to South Africa’s GDP and employment rates, there in lies great opportunities for banks to connect with the informal sector to reach more customers and build a financially included society.

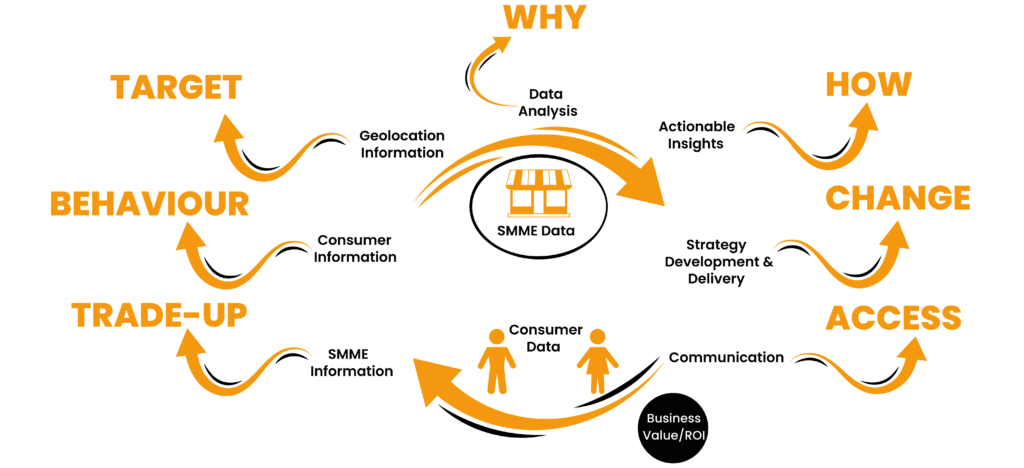

Connecting with the informal sector will assist banks in analysing its complex economy, industries & sectors, payments and savings habits, loan requirements, insurances, technology needs and a lot more. Using this information, banks can build large data sets which can be utilised to offer personalised services to users. This may lead to better fulfilment of real township needs and build higher levels of trust between banks and the informal communities.

The insurance industry has always thrived on data analytics to target its customers. Different types of insurance companies such as travel, health, life, property and casualty, etc., rely on data and derived statistics to segment their customers. Behaviour and preference analysis, personal information, as well as third-party data sources, help to group people into different risk categories, prevent fraud losses, and optimise expenses.

“Driving the integration of insurance into the development agenda and the SDGs is becoming increasingly front-of-mind for stakeholders in our space. Through partnerships and coordination, we can provide inclusive insurance solutions that are pro-poor, humancentric, digitally transformative and data-driven, while mainstreaming gender and driving scale.”

Katharine Pulvermacher, Executive Director, Microinsurance Network Asbl

Insurance businesses need to find ways to enhance risk transfer options through insurance to small and informal businesses, to improve local market recovery, sustain livelihoods and build economic resilience.

The informal retail sector represents significant challenges for the corporate consumer goods and pharmaceutical companies who operate in these markets. They are often unable to successfully track data on informal retail sales, regulate the quality of their products or access customers for research, marketing, or drive the delivery of targeted social impact initiatives.

Focus for retail must be on collecting large sets of data on the South African informal retail sector to improve product development, pricing, distribution, marketing, and customer service strategies.

“There are three big forces converging which will drive the retail sector forward

1. Large and significant informal sector

2. Africa’s people and the entrepreneurial spirit that underpins this sector

3. Data and technology, the key enabler which could unlock the opportunity for all”

www.tradeintelligence.co.za

Modernising informal trade could be key to unlocking economic welfare for low- and middle-income earners and improving the lives of the traders along with the lives of their families, and the communities in which they operate.